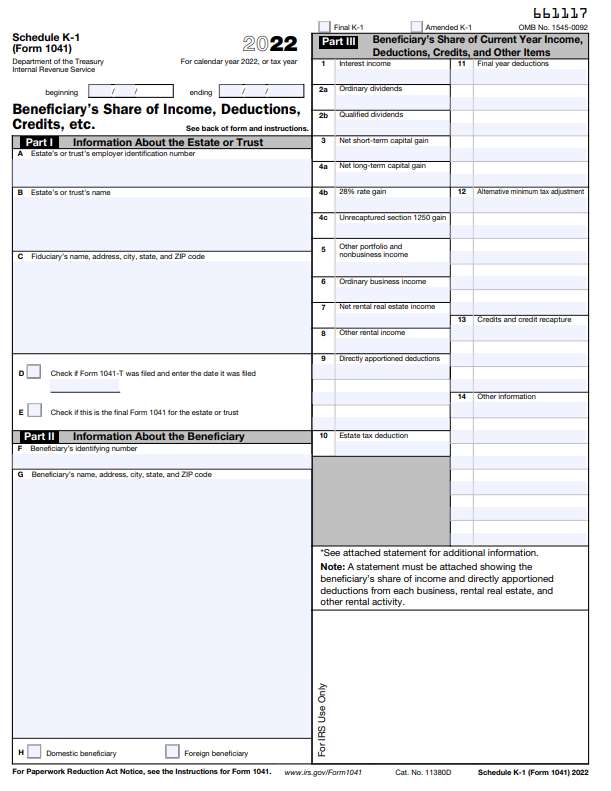

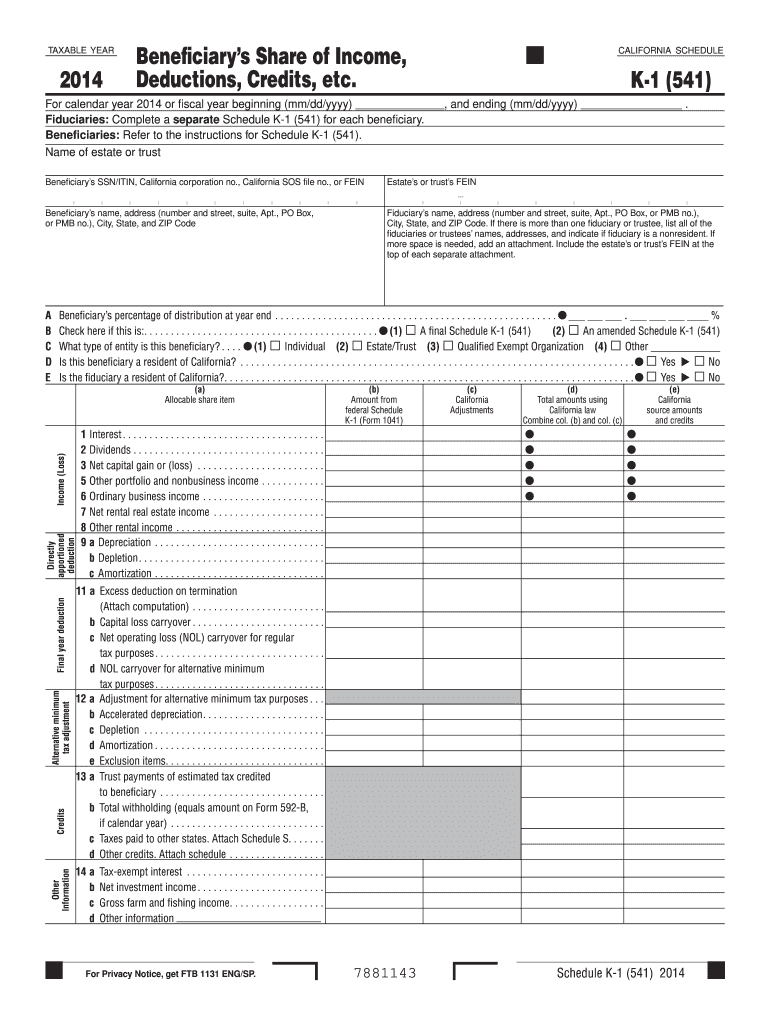

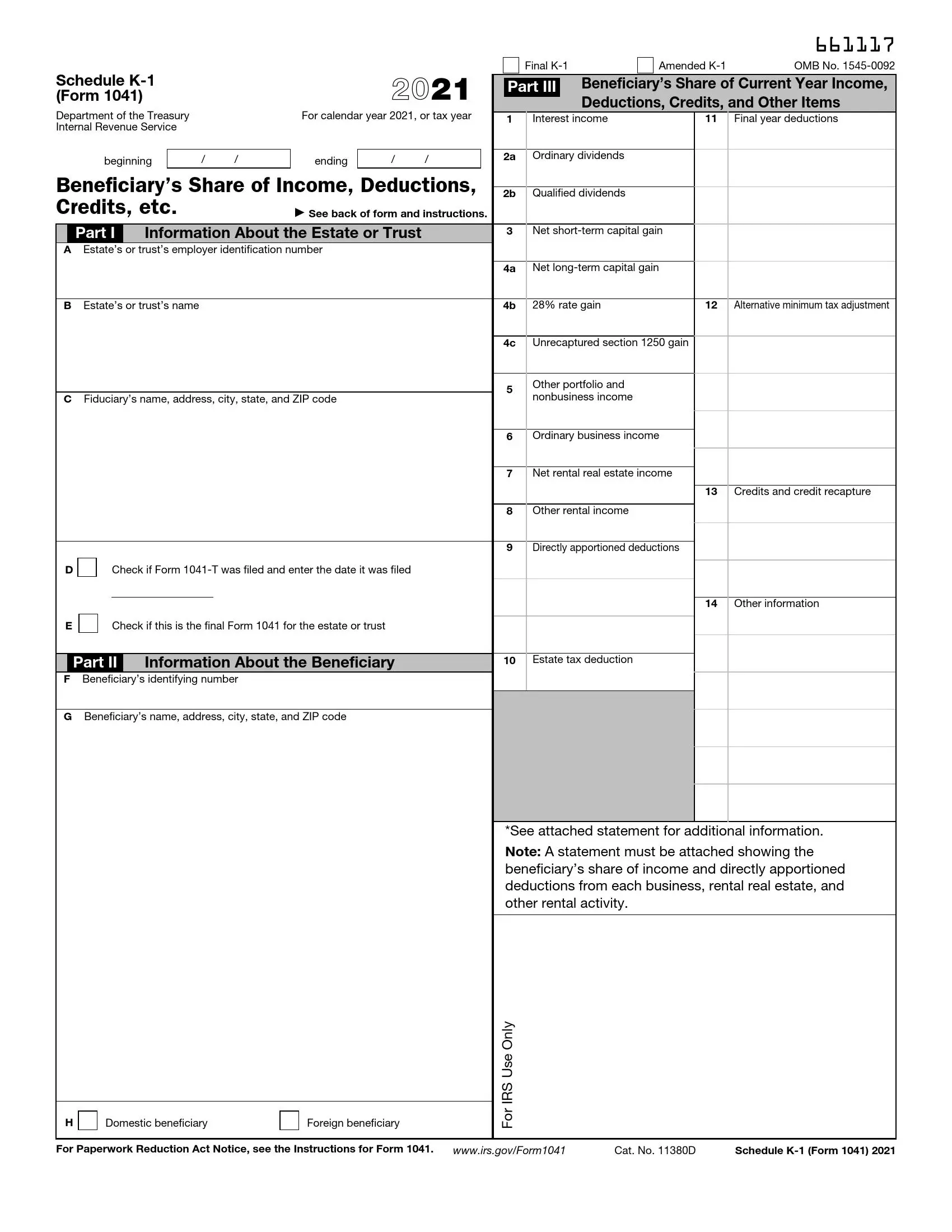

2024 Irs Form 1041 Schedule K-1-T – Schedule K-1 (Form 1041) is used to report a beneficiary then the estate isn’t required to file Schedule K-1 tax forms for beneficiaries. On the other hand, this form has to be filed . Jason Smith, chairman of the House’s tax committee, and his Senate counterpart, Oregon Democrat and finance Chairman Ron Wyden. Newsweek has contacted both for comment via email outside of a normal .

2024 Irs Form 1041 Schedule K-1-T

Source : www.dochub.comWhat is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.comIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIRS Instructions 1041 Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.comWhat Is IRS Form 1041?

Source : www.thebalancemoney.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comWhat is IRS Form 1041 Schedule K 1?

Source : www.dimercurioadvisors.comK1 tax form: Fill out & sign online | DocHub

Source : www.dochub.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov2024 Irs Form 1041 Schedule K-1-T Schedule k 1: Fill out & sign online | DocHub: That’s because the IRS penalty for individuals who fail to make accurate, on-time payments – or don’t pay their estimated taxes at all Taxpayers can choose to schedule the payment in advance. . The IRS taxes a general partnership as a pass-through entity. As a result, the partnership doesn’t have to partners on Schedule K-1. The partnership is required to file Form 1065 by the .

]]>

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)